Due to the COVID-19 coronavirus outbreak and subsequent stay-at-home orders, most of us have some additional free time on our hands. If you have kids and now have to homeschool, you’re probably saying “what extra time!” But I’d say that the vast majority of people have some extra time per day even if it’s just from not having to get ready and commute to work.

While it’s probably not healthy to obsess about being more productive in this uncertain time, making good use of your time and accomplishing some even small goals will go along way to keep your sanity intact while we’re homebound.

With that in mind, I’ve collected a few quick tips on what we can all be doing for our personal finances and investments (instead of binge-watching Netflix!) during the COVID-19 pandemic quarantines.

These are in no particular order, so read them through, and if any grab your interest, give them a go!

1. Update online personal finance apps like Mint, Personal Capital, or Tiller

If you’re not using an online personal finance tracking app like Mint or Personal Capital, I strongly suggest you get started. In my opinion, these types of services greatly surpass in value the locally tracking options like Quicken or YNAB. I realize there will always be some security concerns, but the value these types of services provide greatly exceeds the risk in my opinion.

And if the security/privacy of your data is of the utmost concern, I recommend Tiller. They offer a service that pulls your financial data and transactions into spreadsheets (both Google Sheets and Excel) for you to manage on your own. They never have any access to your account data or transactions.

Regardless, each of these does some basic categorization of your transactions, but you really need to go in and both a) make sure the categories they auto-assign are correct/appropriate and b) create and assign categories to those transactions that are unassigned.

So this is a great time to both review transactions for assigned categories and created/manage any new ones that you need.

Finally, you should also go in and verify that all your accounts are connected. I like to make a master list of all my accounts as some of them are unable to connect at any given time from their back-end providers (Plaid, Yodlee, etc). So on a regular basis, I go to the site and try to connect all my accounts. Also, don’t forget your “offline” accounts and assets like jewelry, valuable collectibles, and any private equity investments.

2. Review equity positions and sizing across your portfolio

This is a tough one as many of us have positions spread out across different accounts. Taking it a step further, how much of each stock is then held in various mutual funds you own in different accounts.

So maybe you have 100 shares of Apple in your IRA, but what if you own an S&P Index fund with Wealthfront? How exposed to Apple are you really?

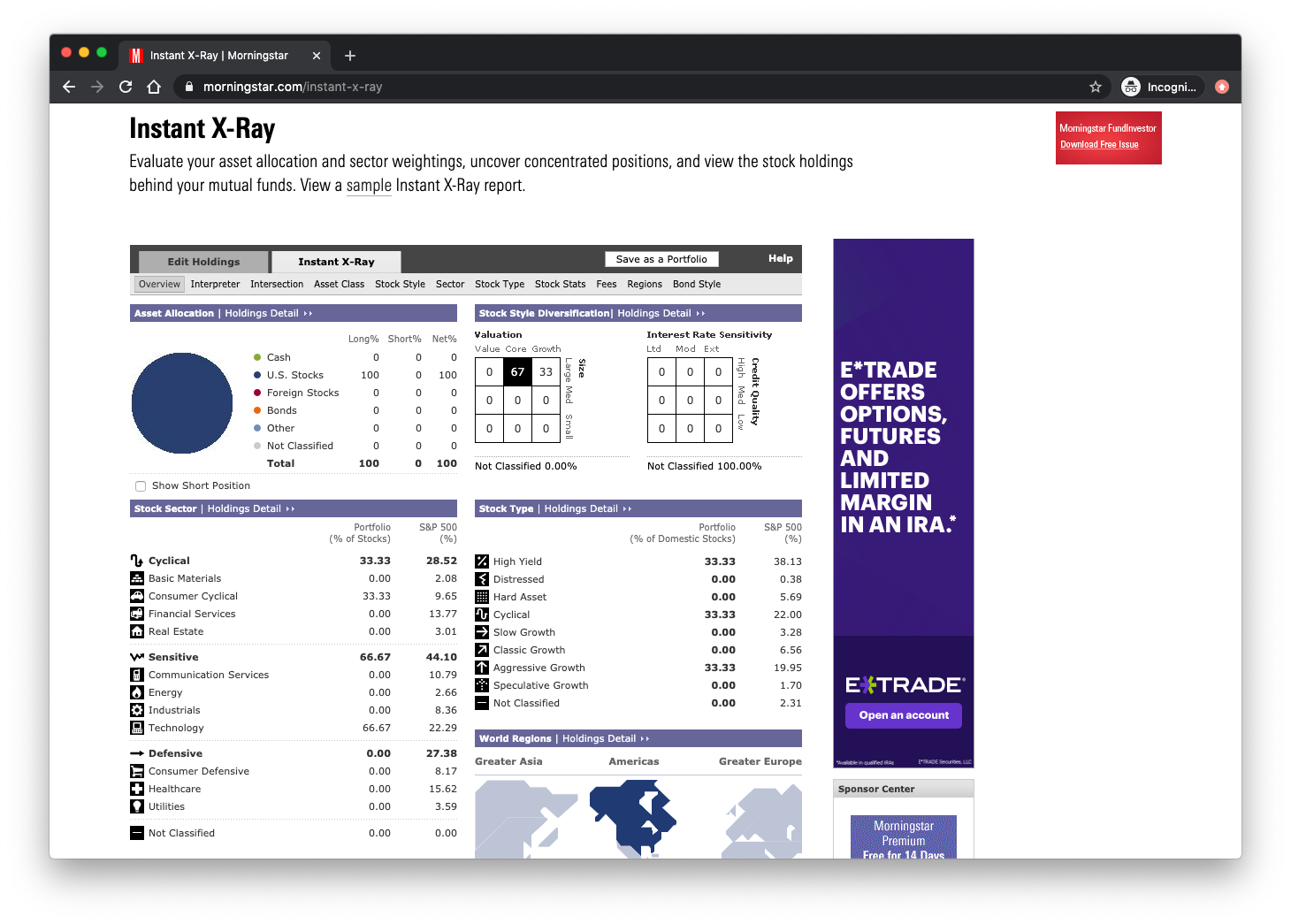

A great tool I like to use to make this process easier is Morningstar’s Instant X-Ray. The free version of Morningstar doesn’t show individual stock holdings, but the paid plans do show this breakdown. Here’s an example with some dummy stock holding data:

Probably not a service you’d use on a frequent basis, but tt’s a quick and easy way to get some insight into your overall portfolio.

3. Review your charitable donations

Now is also a good time to review your charitable donations and giving for the year. While I realize it’s better for the charities to receive the donation in smaller chunks all year long, I just find it easier mentally for me to batch up everything in one month, usually at the end of the year in December.

I suspect I end up giving more this way as I think about the tax benefits and getting some extra in before the end of the calendar tax tear. While there are a few non-profits that are very important to me and I remember easily, I always check what I’ve done in prior years using the ItsDeductible service from Intuit.

Using a single sign-on for your Intuit accounts, ItsDeductible allows you to easily track all types of donations through the year. From cash to clothing, you can quickly use the web or their mobile app to add everything.

At the end of the year, I then go into ItsDeductible and review where I’ve donated in the past and if I’d like to continue again this year if I already haven’t.

Finally, if you use TurboTax, you can automatically import the year’s transactions straight into the Turbo Tax app.

With respect to the current COVID-19 outbreak, each state appears to have sites set up that centralize those charities in need and focusing on the pandemic. In my state, Colorado, there’s a site called Help Colorado Now that lists where you can best donate. Do a quick search for your state and I’m sure you can find something similar.

4. Learn about a new (to-you) cryptocurrency

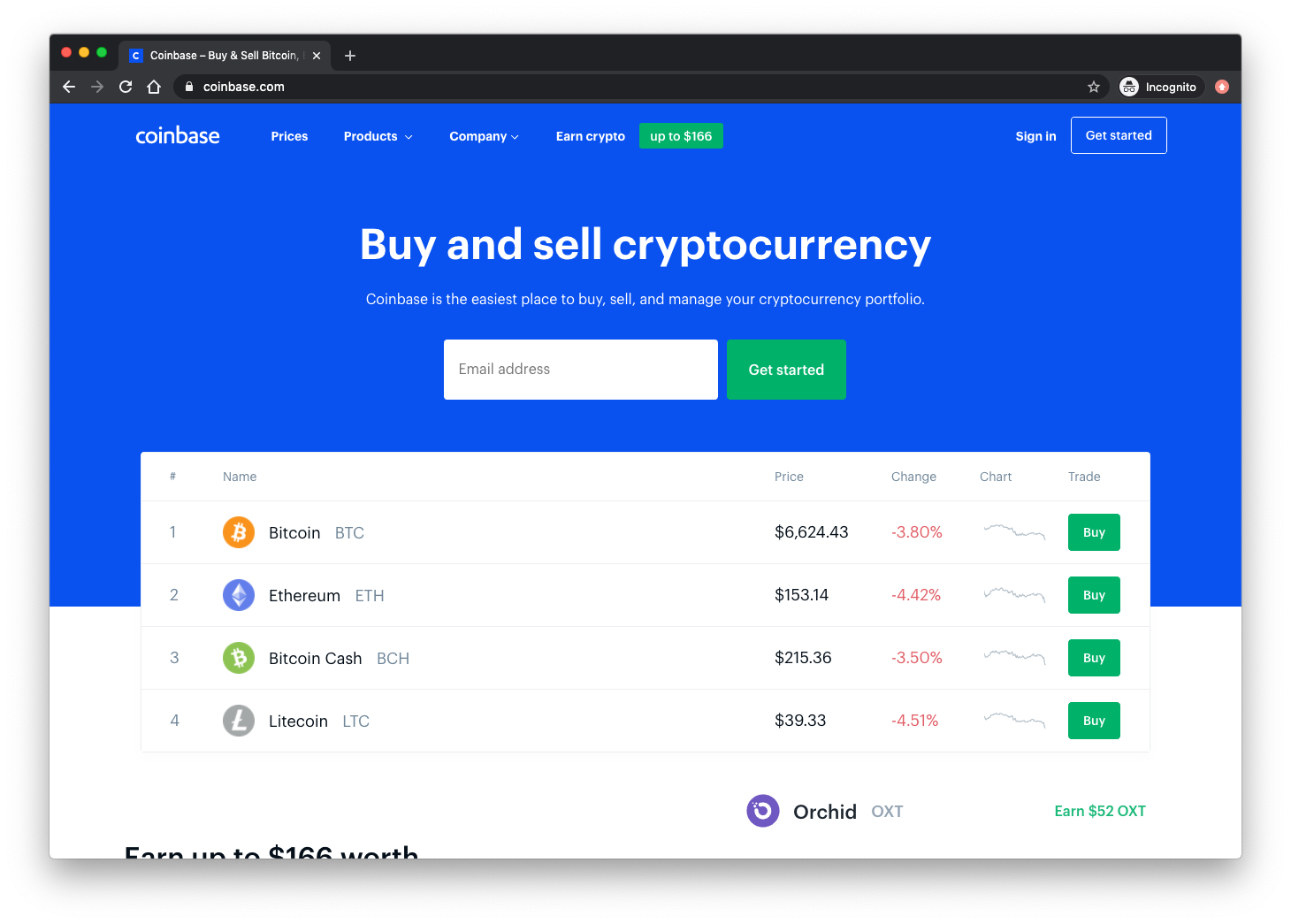

Whether you’re a crypto expert or haven’t a clue how to get started, now is a good time to either learn the basics or get up to speed on some cryptocurrencies you don’t know much about.

While there are many options out there to learn more about crypto, I really like using Coinbase. They make it easy to get started and provide tools that allow you to grow as your expertise does. For example, I started using the service years ago and set up a regular purchase of Ethereum every month when it was under $10.

Over time, as I became more sophisticated, I found it easier and less expensive to use the Coinbase Pro platform. Set up like a more traditional stock trading interface, the platform allows you to place limit orders with the resulting commissions being much less than buying directly on Coinbase proper.

The difference in commission is 0.50% for Coinbase Pro versus 1.49% for Coinbase, which really adds up over time. So while I like the idea of automating the regular purchase of crypto, for now, I just have a recurring todo set in Things and also place limit orders at a variety of levels I’m comfortable purchasing each at.

For example, if you are in the United States and wish to purchase $100 of bitcoin and pay with a U.S. bank account or your USD Wallet, the flat fee would be calculated as $2.99. As noted below in the variable fee section, the variable percentage fee would be 1.49% of the total transaction, or $1.49. Since the flat fee is greater than 1.49% of the total transaction, your fee would $2.99. If you wanted to purchase bitcoin with a credit or debit card, we would charge a fee of 3.99% since the variable percentage fee is higher than the flat fee.

Another great benefit of Coinbase and an excellent way to educate yourself on different cryptos is the Coinbase Earn program. Here they have you watch short videos on particular cryptos and then answer a quiz question about what you saw. There are a variety of options available. A few examples are short video lessons on Orchid, EOS, and Stellar Lumens.

5. Make sure all your statements are downloaded and up to date

How about taking a look at something boring that we all forget to deal with until we’re scrambling to find some docs for a loan or tax time?

A good tip is to develop an automated or semi-automated way of keeping your account statements are downloaded and accessible.

Often many financial institutions will only keep prior statements for a set period of time. If you do need to go back further, best case they’ll charge you and it takes a lot of time but the worst case is they’re simply gone and unretrievable.

You can do backup your statements and docs manually or use a service that downloads and stores them automatically and regularly for you.

A service I’ve used for several years now is FileThis. For free or a monthly subscription, they automatically download and store (local or cloud storage) your statements. Simple idea, but extremely useful and time-saving.

I was formerly an investor via SeedInvest before the company was acquired, but I’m also still a customer of the service.

6. Make a list of stocks (and prices) you’d like to buy if the market goes down

I’m currently researching and writing some of these as a separate detailed post, but this is a good time to make a list of all the stocks you may have had your eye on to either start a position or accumulate additional shares.

I like Jim Cramer’s four-point ranking system along with some rough target prices as it’s a simple system that will be easy to maintain and follow.

I rate all of my stocks on a scale of one to four, the ones being the best buys, the fours being the sells

Basically any system you’ll actually use will work. The key is being disciplined and systematic. When stocks are crashing, you want to be level-headed and able to make informed decisions. A good system will allow you to do this.

7. Research crowdfunding and investments

If you already haven’t, this is a great time to look into crowdfunding investments. Crowdfunding allows anyone to invest in private companies where previously this was limited to accredited investors.

Start to build a list (a Google Sheets spreadsheet is especially good for this) ranking the ones that interest you along with their closing dates and URL. I have a reminder set up to check these sites weekly for new and closing investments.

Here are the major crowdfunding sites right now:

So far, I’ve made the most investments using the Republic platform. I’m not sure entirely why at this point, but they seem to have companies fundraising that meet a lot of my investment interests and theses.

8. Check your credit scores

As we now experience on a regular basis, we’re constantly under threat from hacking, stolen passwords, identity theft, and the like.

Currently, the only solution to these problems is two-fold: 1) freeze your credit reports and 2) check your credit scores on a regular basis.

Many credit card companies offer free credit score checks and some like Discover offer it too non-customers. Another great, free option is Credit Karma. They provides regular updates on your scores from the top credit bureaus.

9. Review/collect tax documents

Tax day has been extended to July 15, 2020 this year. For those of us that will owe, this was welcome news!

If you already haven’t done your taxes, here’s your opportunity to collect and review your tax documents. See number 5 above!

10. Clean your email inbox

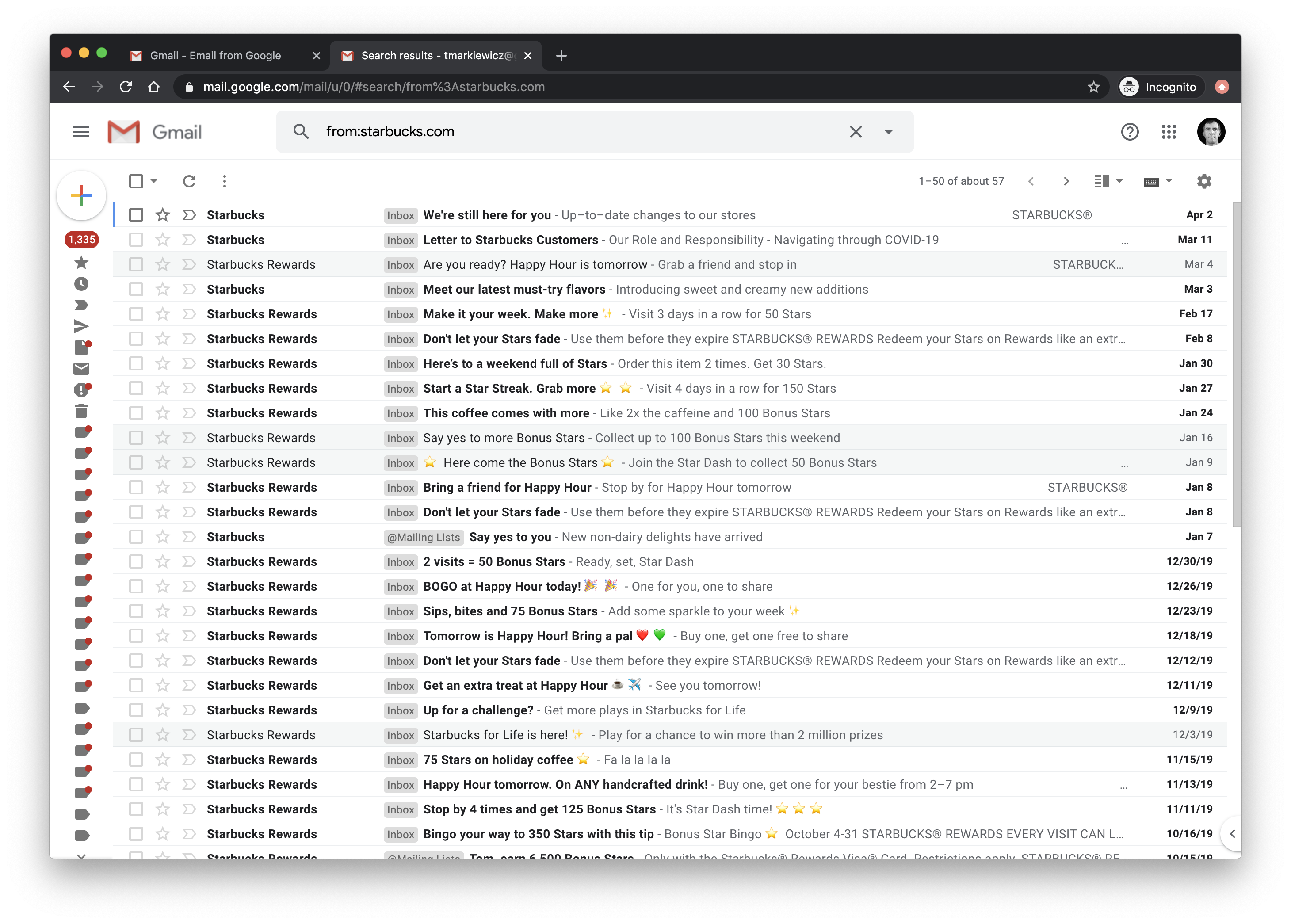

While not specifically related to finances, cleaning your email inbox is always a good idea. Any “free” time is always a great excuse to clean up your email inbox. My favorite Gmail trick is to find a subscription or sender that I really don’t read anymore.

The first step is to create a list of emails from a particular sender using the search box at the top of Gmail. Enter the following in the search field, replacing the from with the domain of the email sender you want to remove.

from:the-domain.com

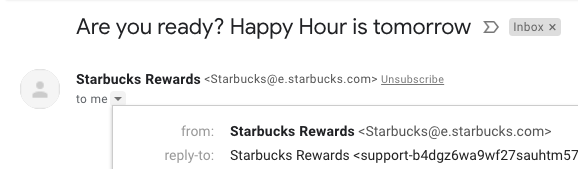

Note: if you’re unsure of the exact domain of the sender, just open one of their emails and either hover your mouse over the sender’s name at the top or click on the small triangle to the right of “to me” under the sender’s name:

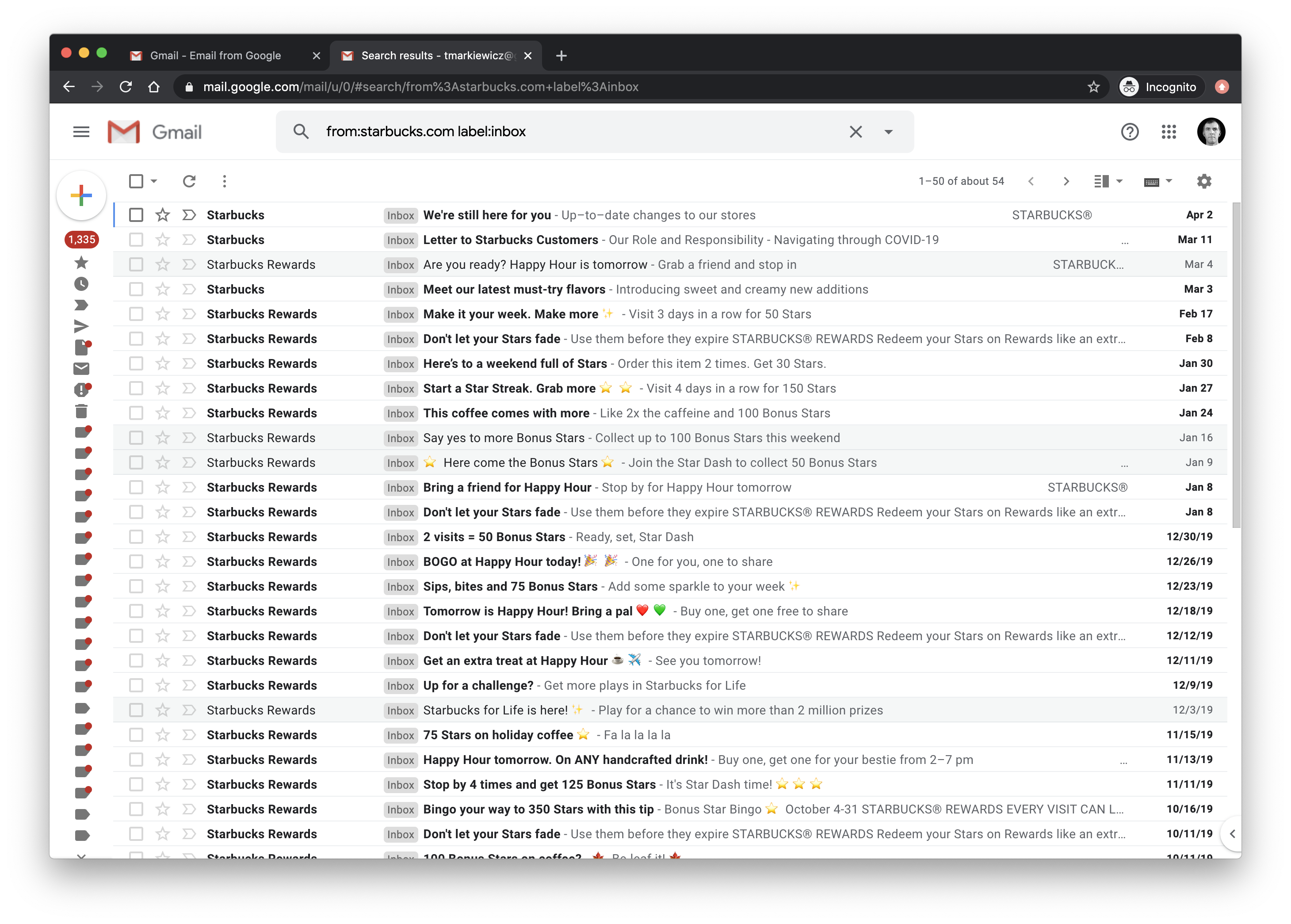

You can now unsubscribe and then delete or archive all the emails. If instead you just want to archive all of the emails from this sender in your inbox, just change the search to the following:

from:the-domain.com label:inbox

If you really don’t want to lose the ability to read the content on a regular basis, the RSS feed reading service Feedbin has an easy way to subscribe to any email newsletter as a feed and read it there instead of your email inbox.

Summary

Obviously, this isn’t a full list, and there are many other ideas. Some of these include just cleaning and curating your social media following/sources. Or even making sure to get some exercise. Take time to care for yourself and family, but consider using some of the extra time at home to power-up your personal finance and investing.

Hopefully, these help out to keep you busy and productive during these challenging times. Are there any you’d suggest? Let me know in the comments.

WealthLed, Copyright 2020 - 2022, All Rights Reserved. WealthLed does not offer any personal financial advice or recommend the purchase or sale of any security or investment for any specific individual. Nothing in this article should be considered personalized investment advice and is for educational purposes only. Additionally, WealthLed has advertising relationships with some of the offers listed on this website. We may receive compensation when you click on links to those products or services.