Financial markets often seem chaotic, but beneath the noise, there’s structure and rhythm. Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, proposes that market prices move in predictable patterns based on human psychology. For traders and investors, understanding this theory can provide powerful insights into market cycles, investor sentiment, and potential turning points.

What Is Elliott Wave Theory?

At its core, Elliott Wave Theory suggests that markets move in repeating cycles driven by crowd psychology — optimism, fear, greed, and uncertainty. These emotional waves form distinct price patterns that repeat across timeframes, from minutes to decades.

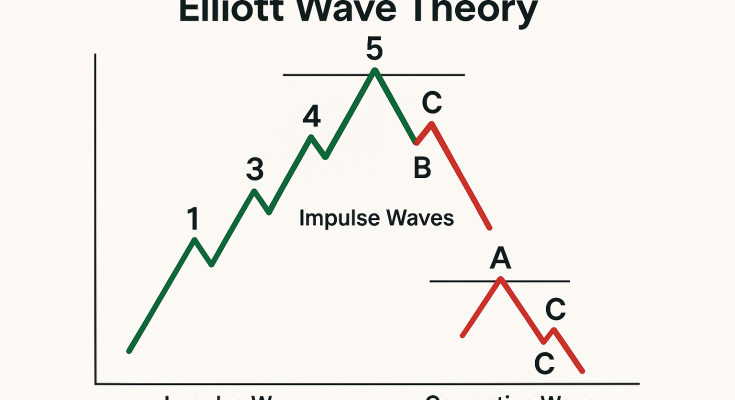

Elliott identified two main types of waves:

- Impulse Waves: Move in the direction of the main trend.

- Corrective Waves: Move against the main trend.

These patterns combine to form the well-known “five-up, three-down” structure:

- Five waves (1, 2, 3, 4, 5) push prices in the trend’s direction.

- Three waves (A, B, C) correct that move before the next cycle begins.

The 5-Wave Impulse Pattern

In an uptrend, the pattern typically unfolds like this:

- Wave 1 – The initial move higher, often overlooked by most traders.

- Wave 2 – A pullback that retraces a portion of Wave 1’s gains.

- Wave 3 – Usually the strongest and longest wave, fueled by broad market participation.

- Wave 4 – A pause or consolidation before the final push.

- Wave 5 – The last burst of enthusiasm before a correction begins.

After these five waves, the A-B-C correction begins, retracing part of the prior advance.

The 3-Wave Corrective Pattern

Corrections unfold in three moves:

- Wave A – The initial counter-trend move.

- Wave B – A partial retracement or “false hope” bounce.

- Wave C – A continuation of the correction, often matching Wave A in size or time.

This A-B-C structure can take many shapes — zigzags, flats, or triangles — depending on market sentiment and momentum.

Fractals: The Market Within the Market

One of Elliott’s most profound insights was that waves exist within waves.

A five-wave pattern on a daily chart might itself be part of a single wave on a weekly chart. This fractal nature means Elliott Wave Theory applies across all timeframes — from intraday scalping to multi-year market cycles.

Applying Elliott Wave Theory in Modern Trading

Modern traders use Elliott Wave analysis alongside technical indicators like moving averages, Fibonacci retracements, and momentum oscillators to refine their entries and exits. The theory is particularly useful for:

- Identifying trend exhaustion and reversal points.

- Forecasting potential price targets using Fibonacci ratios.

- Structuring trades around corrective patterns to time pullbacks and breakouts.

However, it’s important to note that wave counting can be subjective — two analysts may label the same chart differently. Successful application requires practice, discipline, and an understanding that Elliott Wave Theory provides a framework, not a crystal ball.

Pros and Cons

| Pros | Cons |

|---|---|

| Helps visualize market psychology and crowd behavior | Can be subjective — depends on accurate wave labeling |

| Works across all timeframes | Complex structures can confuse beginners |

| Integrates well with Fibonacci analysis | Requires flexibility — rigid interpretations often fail |

Final Thoughts

Elliott Wave Theory remains one of the most enduring frameworks in technical analysis because it captures something timeless — the rhythm of human emotion in markets. When combined with sound risk management and confirmation tools, it helps traders anticipate where we are in the market’s psychological cycle.

In a world driven by fear and greed, understanding the waves beneath the surface can help you trade with greater confidence, patience, and clarity.

WealthLed, Copyright 2020 - 2025, All Rights Reserved. WealthLed does not offer any personal financial advice or recommend the purchase or sale of any security or investment for any specific individual. Nothing in this article should be considered personalized investment advice and is for educational purposes only. Additionally, WealthLed has advertising relationships with some of the offers listed on this website. We may receive compensation when you click on links to those products or services.